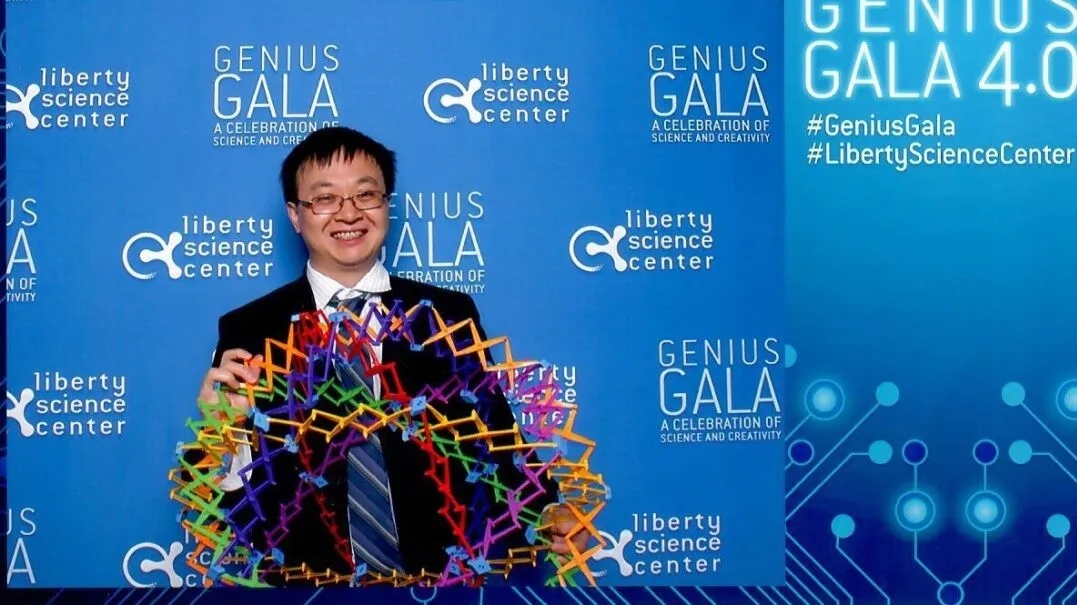

Yu Fuxiang is a distinguished researcher at the Department of Applied Economics, Hangzhou City University (HZCU). His main research interest is quantitative finance. He studied at the University of Tokyo in Japan and the State University of New York at Stony Brook in the United States, and received a master's degree in mathematics and a Doctor's degree in computer science, respectively. Yu Fuxiang has long been engaged in the research of investment and trading strategies on Wall Street, and has more than ten years of experience in the research of ETF (exchange-traded Fund) and its impact on market liquidity.

"The greatest power of quantitative investing is stability."

Yu is simple, easygoing, and ordinary, different from typical images of the financial industry practitioners. He is like an "explorer" on the road forever, always taking new steps. "It seems to me that history repeats itself." Yu Fuxiang stated the core of quantitative investment thought. " The so-called quantitative investment is to find the 'law of irregularities' in historical data through scientific means."

With the support of cutting-edge technologies such as machine learning, AI and cutting-edge computing power, today's quantitative investment is becoming more vigorous. It continuously optimizes the portfolio and improves the way it trades, thereby effectively increasing the rate of return and Sharpe ratio, that is, a stable good return or even a high return. After more than ten years of studying quantitative investment in Wall Street, Yu Fuxiang deeply felt the huge advantages contained in this "stability". Investment must not rush for quick results, Yu always keeps it in mind and applies it in his investment practice.

"In Hangzhou City University, I want to do scientific research that is valuable to society."

Yu Fuxiang believes that quantitative investment is a scientific investment tool, and research on quantitative investment must follow a strict scientific research path. He pointed out that many quantitative investment strategies can provide more liquidity to the market, so that the market can operate more efficiently. Now, Yu Fuxiang is taking this as a goal, step by step towards an ideal quantitative investment strategy.

Yu Fuxiang believes that "good finance" can strongly support the development of the real economy, and the development of the real economy can effectively advance the progress of the financial industry. Only to achieve the positive interaction between the two, a country's economic development can be stable and good in the long run. At the same time, he is confident about the development prospects of ETFs in China, and as more and more people choose professional institutions for investment and financial management, ETFs will play an important role in promoting more efficient operation of the market.

Yu Fuxiang is an unapologetic optimist when it comes to forecasting market prospects. He firmly believes that the future of China's financial market must be a "blue ocean" and full of opportunities. He is the "doer" who swims in this blue ocean and walks forward on the road of "doing valuable scientific research for society."

"The so-called investment is' investing in people '."

"Hangzhou City University is a vibrant university." Yu Fuxiang said. In his opinion, joining the HZCU is an effective way to devote himself to the training of quantitative investment talents in finance, which is also in line with his experience. He highly agrees with the blueprint of HZCU to create a high-level applied university, and he returned from Wall Street and resolutely chose to join HZCU.

"HZCU Students are very motivated, and I want to help them in any way I can." Yu Fuxiang believes that in order to become a qualified investor, not only lies in the improvement of knowledge, but also in the cultivation of personality. He wants his students to "always think about others," to dream of being financial people, to look at interpersonal relationships from a scientific perspective, and to evaluate every investment behavior with rational thinking.

Now Yu Fuxiang is making a different kind of investment. At present, he is looking forward to having more like-minded researchers join his research team. He hopes to discuss financial innovation at the ideological level with more people, and jointly study the feasible path to optimize quantitative investment strategies, so that "good finance" can contribute more to China's economic development.

Is the explorer, is the doer, is the guide, from Wall Street to HZCU, Yu Fuxiang began a new "investment" process.